Major Federal Energy Tax Credits Are Ending Soon — Here’s What You Need to Know

The recently passed One Big Beautiful Bill Act (OBBBA or OB3) makes sweeping changes to federal energy-related tax incentives for individuals. Many of the credits for home energy efficiency upgrades, clean energy systems, and electric vehicles are being phased out much sooner than expected. In some cases, the deadline to qualify is less than a year away.

If you’ve been thinking about installing solar panels, upgrading your home’s energy efficiency, or purchasing an electric vehicle, now may be the time to act. Here’s a breakdown of the changes and the important dates to keep in mind.

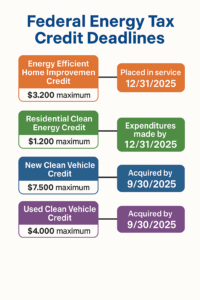

- Energy Efficient Home Improvement Credit

- Ends: For property placed in service after December 31, 2025.

- What it covered: A credit of up to 30% (maximum $3,200 when two different credits are combined) of the cost of qualified improvements such as insulation, energy-efficient windows and doors, and certain heating/cooling systems—subject to annual and per-item limits.

- Residential Clean Energy Credit

- Ends: For expenditures made after December 31, 2025.

- What it covered: A credit of up to 30% for installing solar panels, solar water heaters, geothermal systems, small wind turbines, fuel cells, and battery storage at your home.

- Clean Vehicle Credits

- New EVs: Ends for vehicles acquired after September 30, 2025.

- Used EVs: Ends for vehicles acquired after September 30, 2025.

- What they covered: Up to $7,500 for new EVs and up to $4,000 for qualifying used EVs.

- Alternative Fuel Vehicle Refueling Property Credit

- Ends: For EV charging equipment placed in service after June 30, 2026.

- What it covered: Up to $1,000 for installing a home EV charger.

Why It Matters

These credits can save you thousands of dollars—but only if you act before the deadlines. Whether you’re planning to go electric for the first time, upgrade your business fleet, or install a charger at home, waiting too long could mean missing out on some serious tax savings.

What You Can Do Now

If any of this is on your to-do list for the next year or two, we recommend moving sooner rather than later. With the credits set to expire in late 2025 and mid-2026, and demand already high for EVs and charging equipment, you’ll want to give yourself plenty of time to make your purchase and have everything installed.

Need help figuring out the tax side of things? That’s what we’re here for.

This post is for general information only and isn’t tax, legal, or accounting advice. Tax rules change often, and what’s here may not apply to your specific situation. Please consult a qualified tax professional before acting on any information. Reading this does not create a client–practitioner relationship.