The One Big Beautiful Bill Act (OBBBA, or OB3) has sparked a lot of conversation — and confusion — online. Some social media posts claim that OB3 eliminates taxes on Social Security benefits entirely. Others suggest that it changes the formula for calculating how much of your benefits are taxable.

Let’s set the record straight by separating fact from fiction — and walk through a real-life example to show exactly how the new $6,000 senior deduction works.

Fiction #1: OB3 stops Social Security from being taxed and/or reduces the income used to calculate the tax

The truth: OB3 did not change the formula for determining whether Social Security is taxable. Your benefits are still taxed based on provisional income, which equals:

Other income (pensions, IRA/401k withdrawals, dividends, capital gains, etc.)

+ tax-exempt interest

+ ½ of your Social Security benefits.

= Provisional Income

If your provisional income is low, you may owe little or no tax on your benefits. If your other income is higher, some to most of your Social Security will still be taxable. Up to 85% of your Social Security is taxable.

The new $6,000 senior deduction (or $12,000 if married filing jointly and both are 65+) is applied after your adjusted gross income (AGI) is calculated. It does not reduce provisional income, and it does not change the taxable portion of your Social Security benefits.

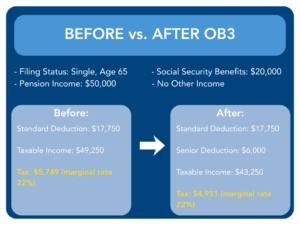

Example: Before vs. After OB3

Scenario:

-

- Pension income: $50,000

- Social Security benefits: $20,000

- Filing Status: Single, Age 65

- No other income

Step 1 – Provisional Income:

50,000 (pension) + $0 (tax-exempt interest) + $10,000 (½ of SS) = $60,000

Step 2 – Taxable Social Security:

With $60,000 provisional income, the formula results in 85% of Social Security taxable = $17,000

Step 3 – Adjusted Gross Income (AGI):

$50,000 pension + $17,000 taxable SS = $67,000

Step 4 – Taxes:

Before OB3:

Standard Deduction (age 65 single): $17,750

Taxable income: $67,000-$17,750 = $49,250

Tax: $5,749 (marginal rate 22%)

After OB3:

Standard deduction (age 65 single): $17,750

Senior deduction: $6,000

Taxable income: $67,000 – $17,750 – $6,000 = $43,250

Tax: $4,951 (marginal rate 12%)

Tax Savings: in this example, your taxable income would be reduced by $6,000, and taxes by $798.

Fiction #2: Statements from the Social Security Administration prove benefits are now tax-free

The truth:

Shortly after OB3 passed, the Social Security Administration sent out an email that included several incorrect or possibly misleading statements about the law. Here’s what was said — and the reality:

Claim: “The bill ensures that nearly 90% of Social Security beneficiaries will no longer pay federal income taxes on their benefits…”

Fact: Possibly true for 2025 depending on income levels, but misleading. It’s not because Social Security benefits are now tax-free — it’s because many lower-income seniors will have their taxable income reduced to zero due to the new deduction.

Claim: “The new law includes a provision that eliminates federal income taxes on Social Security benefits for most beneficiaries…”

Fact: False. The calculation for taxing benefits hasn’t changed, and benefits can still be taxable depending on your income.

Claim: “Additionally, it provides an enhanced deduction for taxpayers aged 65 and older…”

Fact: True — there is a $6,000 deduction ($12,000 for joint filers if both are 65+), but it’s not in addition to another related Social Security tax break or exemption. It’s simply a new deduction with its own eligibility and phase-out rules.

Fiction #3: Everyone who receives Social Security will benefit from the new deduction

The truth:

- Eligibility: You must be 65 or older at the end of the tax year.

- Income limits: Deduction is available in full if your Modified Adjusted Gross Income (MAGI) is $75,000 or less for single filers or $150,000 or less for married filing jointly.

- Phase-out: Starts above these thresholds, reducing the deduction by $100 for every $1,000 over the limit. It’s fully phased out at $135,000 for singles and $210,000 for joint filers.

For many lower- and middle-income seniors, the deduction could completely eliminate their federal tax liability. Higher-income seniors may see only a partial benefit or none at all.

Bottom Line

OB3’s $6,000 senior deduction is real — but it’s not a Social Security tax exemption, and it doesn’t change how Social Security benefits are taxed.

It’s a midline deduction for those age 65+ under specific income limits, and it can apply even if you don’t receive Social Security yet. For many, it could mean owing no federal income tax in 2025, but for others, the benefit may be reduced or phased out entirely.

This post is for general information only and isn’t tax, legal, or accounting advice. Tax rules change often, and what’s here may not apply to your specific situation. Please consult a qualified tax professional before acting on any information. Reading this does not create a client–practitioner relationship.